About a year ago a friend of mine named Ruben formed a new type of organization called Polis - Community of Communities. You can read about Polis here, but in brief, Polis begins to describe itself as follows:

The world's next prevalent economic and governance system is called cooperatism and can be a a driving force for healing our biosphere. With Polis we are helping its evolution along by providing methods, tools and funding to enable an ecosystem of distributed, self-governing organizations that value people and planet over profit.

Ruben asked me if I had interest in modeling how money could be transacted on a hypothesized system comprised of a "trusted" social network, funded by personalized crypto-generated Universal Basic Income and balanced by Demurrage (real life experiments like this already exist, see Circles for one example).

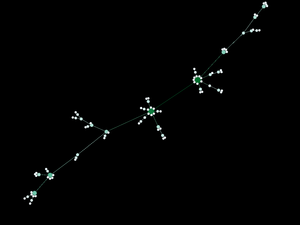

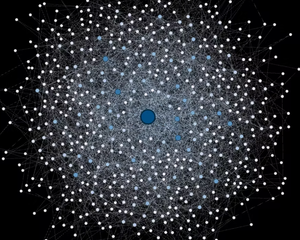

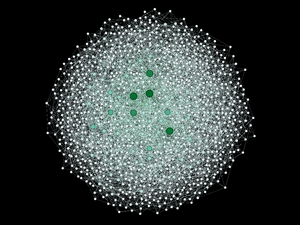

Of particular interest was modeling, as a small network was established and grew to a larger network, the bootstrapping phase of network commerce to identify liquidity bottlenecks and discover how these bottlenecks might be overcome.

I was intrigued and said yes. We published our preliminary results on the Polis blog in a series of posts that are summarized below (and reproduced on this blog).

After a year or so, having established the bones of the model and generating preliminary findings, we paused the work to focus on other things. Perhaps we'll return to this particular analysis. Regardless, we learned much and it was really fun.

A Reading List

As stated, we have published a number of articles describing the motivation and mechanics of our hypothesized economic model based on transitive-transactions and trust-networks and summaries of our research and conclusions to date. The articles are sequential and designed to build a knowledge base and limit repetition. Therefore, below we present a reading list to help guide the reader.

The Model

- The reader should begin with the description of our Economic Model. This article discusses the motivation, variables and the dynamics of the model.

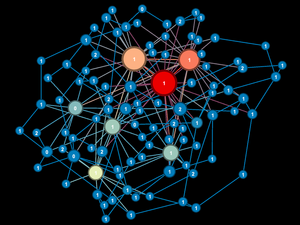

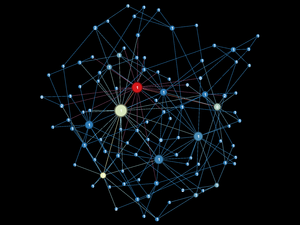

- Supporting the Economic Model are two further articles. The first presents the Transitive-Transaction pseudo algorithm we have adopted. The second discusses the mechanics of the Liquidity Situation, an important artifact of the Transitive-Transaction approach.

The Networks

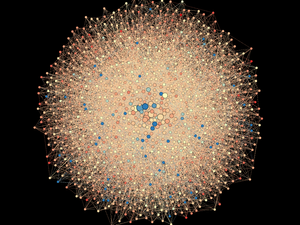

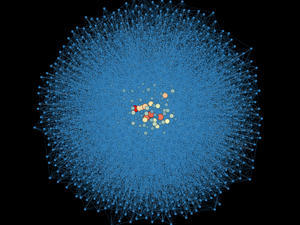

- The Economic Model requires an initial network as an input. Networks describes how we create the base networks used in our modeling and what are their statistical properties.

- A fun video of a randomly growing network using preferential attachment can be found here.

The Simulations

- We have produced three articles that present our modeling results in depth. The first describes and discusses possible Solutions to the Liquidity Situation The second compares the dynamics between "like" Networks of 100 or 1000 Agents. The third discusses the relationships between UBI, Demurrage, Prices and the Money Supply.

All the results presented are derived from stochastic simulations personally programmed and executed in Matlab and are freely available in Github here. All the network graphics were personally produced using Gephi.

Happy Reading!