Note: This article was written while conducting research for the Polis Foundation and was first published on their blog here.

On a trusted network employing transitive transactions to facilitate commerce between untrusted actors, there will be situations when a transaction will fail due to a lack of liquidity along the network path lying between the buying agent and the selling agent.

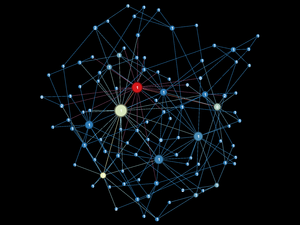

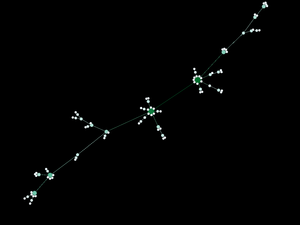

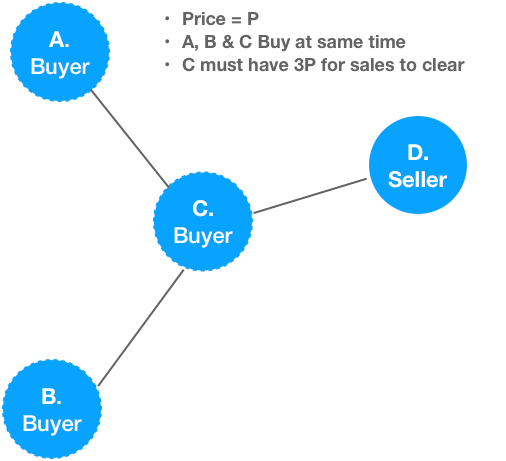

The figure below illustrates the problem.

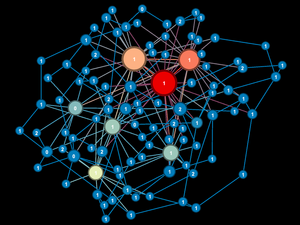

Agent C is trusted by Agents A, B and D, but Agent D only trusts Agent C. Consequently Agent D, the only seller on the network, will only accept Agent C’s currency for her goods.

If Agents A, B and C want to transact with D in the same time interval then Agent C must have on hand an amount of C coins equal to 3 times the price of the good if all the transactions are to complete. This places a large cash flow burden on Agent C, most of which is out of her control.

Of course Agent C obtains equal compensation (currency) from Agents A and B, but it’s only valuable to Agent C if C can spend it and C cannot spent it with Agent D.

Depending on the order of the purchasing is possible that A and B complete their transactions before C and leave C without enough of C coins to make her own purchase!

How severe this problem becomes for a given network will depend on a number of factors such as the technical characteristics of the network itself, the money supply, the price of goods, the seller to buyer ratio, model parameters such as transaction-distance and so forth.

Future posts will analyze the this situation through simulation, looking at these and other factors, to seek ways to best manage or eliminate the "liquidity" situation.